Income of a resident company from the business of airsea transport banking or insurance is taxed on a worldwide basis. Short title and commencement 2.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

. How To Pay Your Income Tax In Malaysia. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. A bank licensed under the Islamic Banking Act 1983.

Key points of Malaysias income tax for individuals include. Other income is taxed at a rate of 30. As per the Income Tax Act whatever professional tax.

An individual who has taken an education loan for higher education can avail the tax deduction under Section 80E of the Income Tax Act 1961The best part about this deduction is one can avail it even after availing the maximum provided deduction of Rs1 50 000 under Section 80C. Tax Offences And Penalties In Malaysia. Guide To Using LHDN e-Filing To File Your Income Tax.

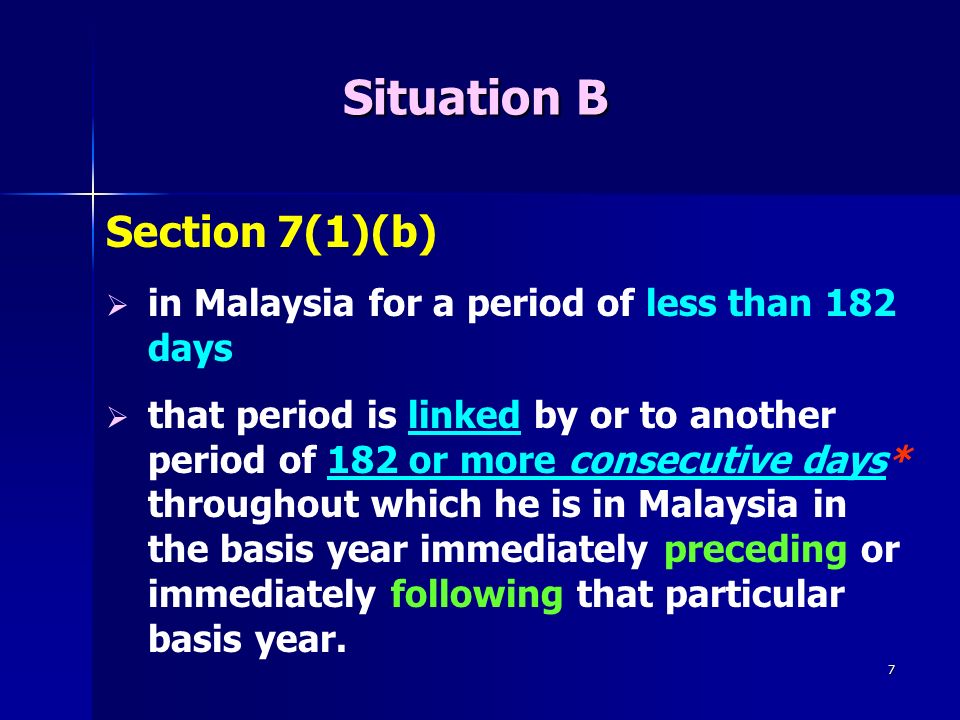

Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

How Does Monthly Tax Deduction Work In Malaysia. Income Tax Act 1959 Being an Act to impose a tax upon incomes and to provide for its assessment and collection. Charge of income tax 3 A.

There is no ceiling in monetary terms in the Income Tax Act in article 276 of the Constitution. A bank or a finance company licensed or deemed to be licensed under the Banking and Financial Institutions Act 1989. This Act may be cited as the Income Tax Act 1959.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Tax Benefits under Section 80E. 1 In this Act unless the contrary intention appears.

A Labuan entity can make an irrevocable election to be taxed under the Income Tax Act 1967 in respect of. Non-chargeability to tax in respect of offshore business activity 3 C. Tax rebate for self.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Nonresidents are subject to withholding taxes on certain types of income. Sports equipment for sports activities is defined under the Sports Development Act 1997.

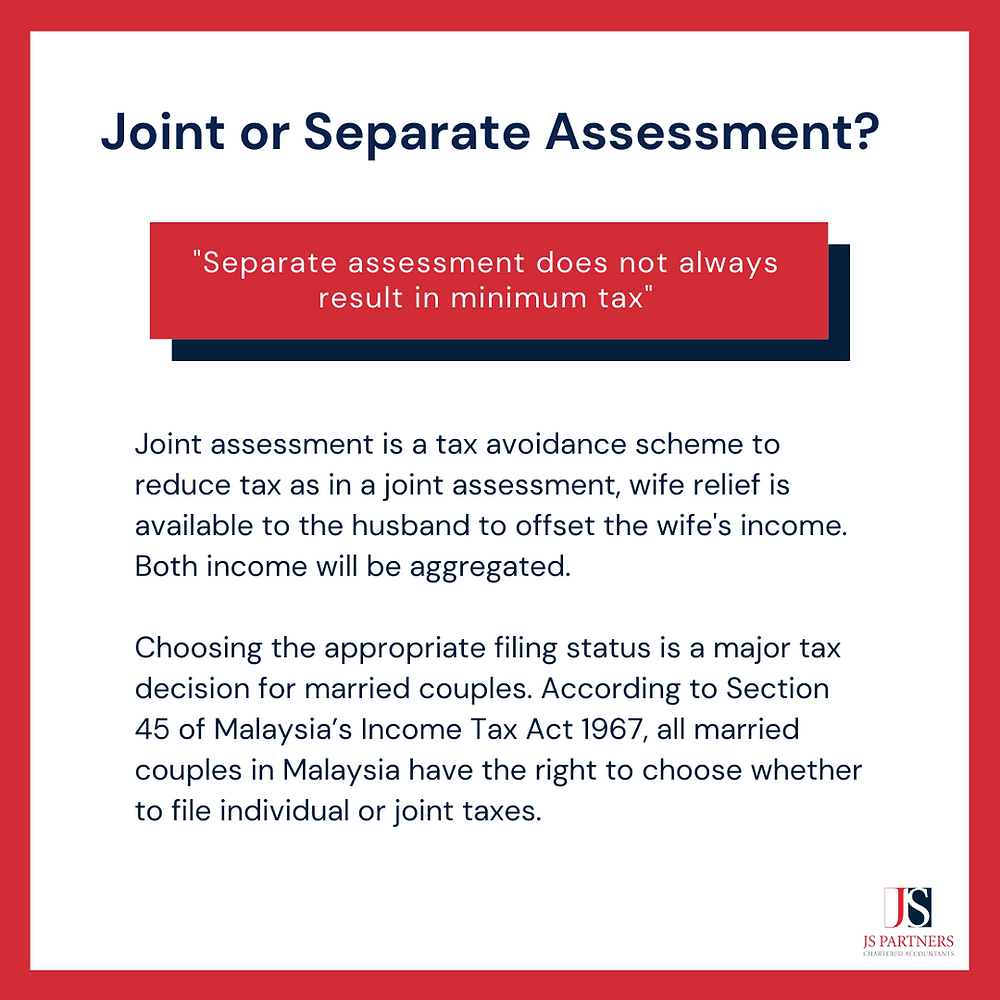

Tax rebate for. The Government of Malaysia allows us to claim 7 types of income tax reliefs for education medical expenses for parents alimony and lifestyle to maximize your tax refund. A tax rebate reduces the amount of tax charged there are currently four.

Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. Any State Government is not eligible to impose more than Rs2 500 annually as professional tax. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged.

Taxation on a worldwide basis does not apply when income attributable to a Labuan business activity of a Labuan branch or subsidiary of a Malaysian bank is subject to tax under the Labuan Business Activity Tax Act 1990. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Special Tax Deduction On Rental Reduction

Tax Implications On Digital Services Crowe Malaysia Plt

Income Tax Act 1967 Act 53 With Selec

Different Types Of Income Tax Assessments Under The Income Tax Act

Malaysian Tax Issues For Expats Activpayroll

Income Tax Act 1967 Act 53 With Selected Regulation Rules Shopee Malaysia

When Are You A Tax Resident In Malaysia Simple Explanation

What Is Transfer Pricing And Why Does It Matter Cheng Co Group

Tips For Income Tax Saving L Co Chartered Accountants

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

These Are The Personal Tax Reliefs You Can Claim In Malaysia

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Malaysia Personal Income Tax Guide 2021 Ya 2020

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Malaysia Personal Income Tax Relief 2021

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 9th Ed